HELENA — Letters about property appraisals that will impact future property taxes went out recently to residents in Lewis and Clark County, with many reporting a sharp increase in their assessed value and taxable value compared to prior years.

Every two years, the Montana Department of Revenue sends out new assessments of properties that take into account several factors such as improvements made to the property and the housing market. Looking at the most recent assessments, the sharp increase in real estate prices seems to have a significant impact on the values.

We were able to look at new assessments of several Helena area properties, both in and outside city limits, which were provided to us by residents. All properties we saw documentation for were primary residences of families who work and live in the Helena area.

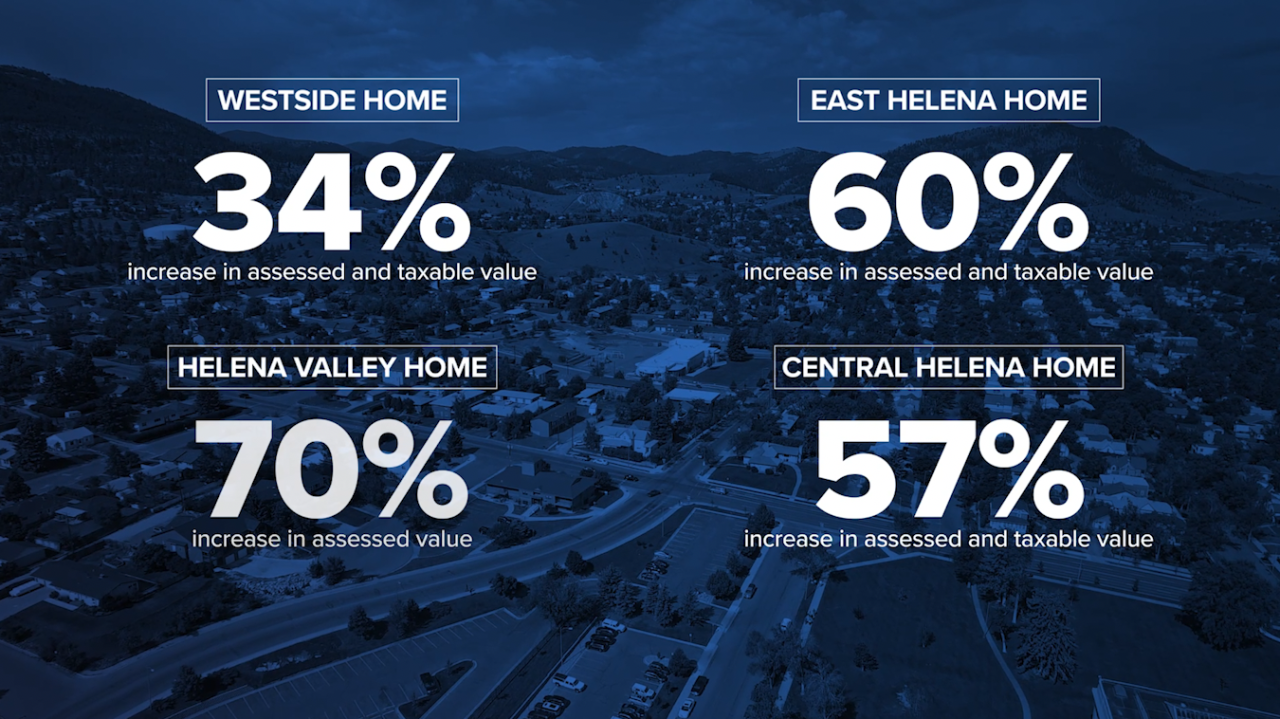

Across the board, there was a significant jump in assessed value and taxable value. On the low end, a west-side Helena home is seeing a 34% increase in its assessed and taxable value. On the high end, a Helena Valley home is seeing a 70% increase in assessed value and a 66% increase in its taxable value compared to the prior cycle.

A home purchased in the last five years in Helena saw a 57% increase in its assessed and taxable value. Meanwhile, a home that was purchased decades ago in East Helena saw a 60% increase in its assessed and taxable value.

While taxable value does not directly translate to what an individual will pay for their property taxes, it is the value used by government agencies to determine property taxes along with a person's total tax rate.

We spoke with property owners from around Lewis and Clark County, and they had some mixed feelings about the situation.

"I just have a small, one-bedroom, condo and it is downtown, so taxes are already high. I mean, I understand the property values have gone, but I want to live in it. You know, I'm on fixed income, so it's really hard," said Zee Eller, a Helena area resident.

"I just became aware of it recently. I'm a big supporter of our local services. I think our local governments, our city and county governments provide a lot of essential services. They have a lot of challenges in front of them and they need the resources to attack those challenges," said Gary John Wiens, a Helena area resident.

"The tax bill amount was surprising, but with the increase in overall values of homes and land in Montana, it didn't wasn't overly surprising. Just the amount of tax was as far as the assessed market value. That wasn't a surprise that that went up," said Anthony Cacace, a Helena area resident.

If property owners disagree with the department's determination of the value of their property, they may submit a request for informal classification and appraisal review.

The Department of Revenue said in a press release they will also be public meetings across the state in July.

MTN reached out to the Department of Revenue about the letters, but calls were not immediately returned.